Why Choose Augment AI

Our team is made up of experts in business and technology, behavioral scientists, designers, and engineers, all committed to a customer-focused and design-first approach.

Boosting enterprises with comprehensive, secure AI-driven solutions, customized to meet their specific requirements.

Our team is made up of experts in business and technology, behavioral scientists, designers, and engineers, all committed to a customer-focused and design-first approach.

Our AI solutions adhere to the latest regulations and uphold the highest standards of data security.

We provide AI solutions customized to your specific needs, seamlessly integrating with your existing systems for optimal performance.

Our team brings deep expertise in cutting-edge AI technologies, with extensive experience in deploying solutions across major tech organizations.

Delivering context-aware, high-fidelity results that you can consistently rely on.

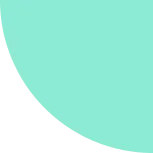

Explore enterprise data through conversational queries to discover reliable results. Enable your teams with managed access to information, boosting productivity.

Pose questions in natural language and receive summarized results with source references.

Facilitate appropriate information distribution across your teams.

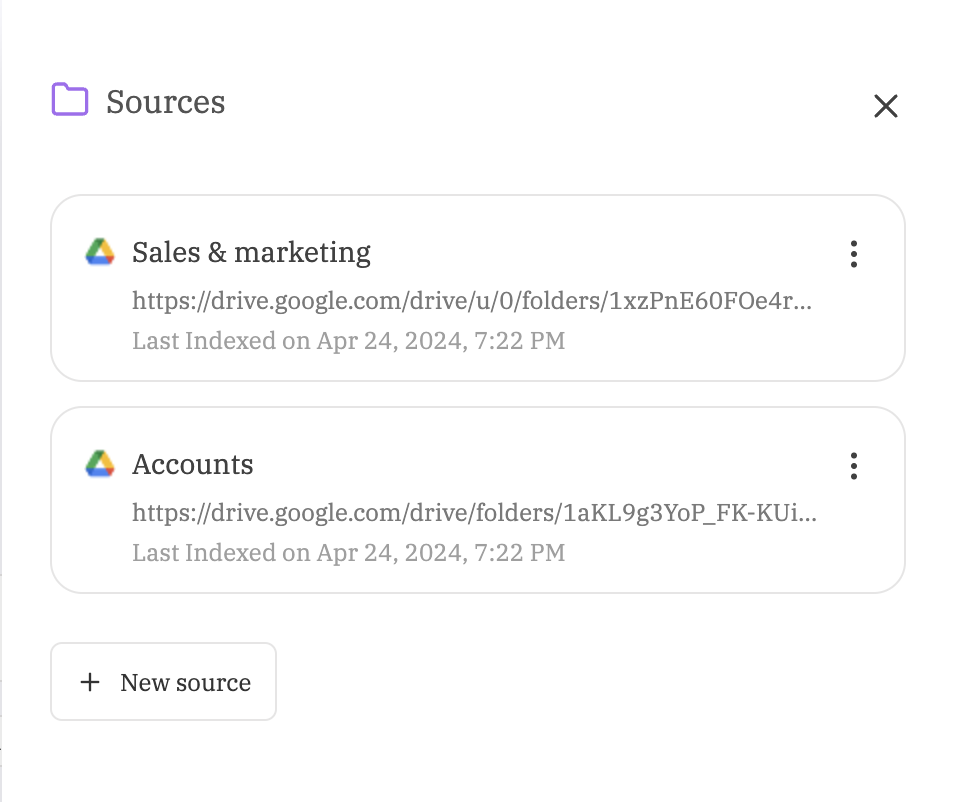

Seamlessly integrate with your existing tools like Google Drive, Dropbox, and more.

The gap analysis between policy and compliance using Large Language Models (LLMs) involves employing advanced AI models like GPT to understand, analyze, and compare complex policy documents and compliance data. Unlike traditional NLP techniques, LLMs can handle nuanced language, infer context, and process unstructured data more effectively.

Extracting and summarizing insurance policies using AI simplifies complex documents by leveraging tools like Large Language Models (LLMs) to identify and present key information such as coverage, exclusions, terms, and claims processes. These models analyze policy documents in various formats, extracting relevant details and generating concise summaries tailored to user needs. This approach enhances clarity, saves time, and enables quick comparisons across policies, empowering customers and businesses to make informed decisions effortlessly.

AI models read and parse insurance policy documents in various formats, such as PDFs or text files.

Advanced tools like PDF parsers or OCR (Optical Character Recognition) systems are used to digitize non-editable documents.

LLMs identify essential elements such as coverage details, exclusions, terms, premiums, and claims processes.

The models are trained to recognize legal and domain-specific terminology.

LLMs generate concise summaries tailored to the user’s needs (e.g., highlighting only exclusions or summarizing benefits).

Summaries maintain contextual accuracy and readability for diverse audiences, from customers to legal experts.

Policies can be compared side-by-side, focusing on specific aspects like cost, coverage, or benefits.

Personalized recommendations can be provided based on user preferences or organizational requirements.